The Most Powerful Features Of AGA’s AI Trading System

This image is property of www.wallstreetzen.com.

Introduction

In today’s ever-evolving financial landscape, the digital transformation of trading has introduced innovative tools and platforms to enhance investment strategies. Angel Guardian Alliance (AGA) has developed an AI-driven trading system that leverages advanced technology to provide investors with a unique edge in the market. This article will delve into the key features that set AGA’s trading platform apart, offering insights into how the system operates and the benefits it offers to users.

AI Quantitative Trading

AGA’s AI quantitative trading system is powered by a quantum algorithm that allows for automated analysis and decision-making. By harnessing data-driven insights and market trends, the system maximizes profitability while minimizing human intervention. This advanced technology ensures optimal trading outcomes in various market conditions, making it a valuable tool for investors seeking to enhance their trading strategies.

Zero Liquidation Risk

One of the standout features of AGA’s trading system is its ability to prevent liquidation by utilizing ultra-high-frequency trading techniques with minimal holding times. With trades executed in under 30 seconds, the platform ensures stability and minimizes risks, even in volatile market environments. This risk management strategy sets AGA apart from traditional trading platforms, offering users a level of security and confidence in their investment activities.

Multi-Liquidity Access

AGA provides users with access to multiple liquidity providers, enabling competitive pricing, fast execution, and deep market access. The platform’s multi-liquidity approach enhances trading efficiency and reduces the impact of market fluctuations on trades. By diversifying liquidity sources, AGA offers users a seamless trading experience with enhanced flexibility and market connectivity.

This image is property of www.greatworklife.com.

Risk-Free Arbitrage Opportunities

AGA’s trading system identifies arbitrage opportunities across different markets, allowing users to profit from price discrepancies without traditional trading risks. This risk-free arbitrage strategy generates a consistent income stream while minimizing exposure to market volatility. By leveraging these opportunities, investors can optimize their trading outcomes and achieve sustainable returns over time.

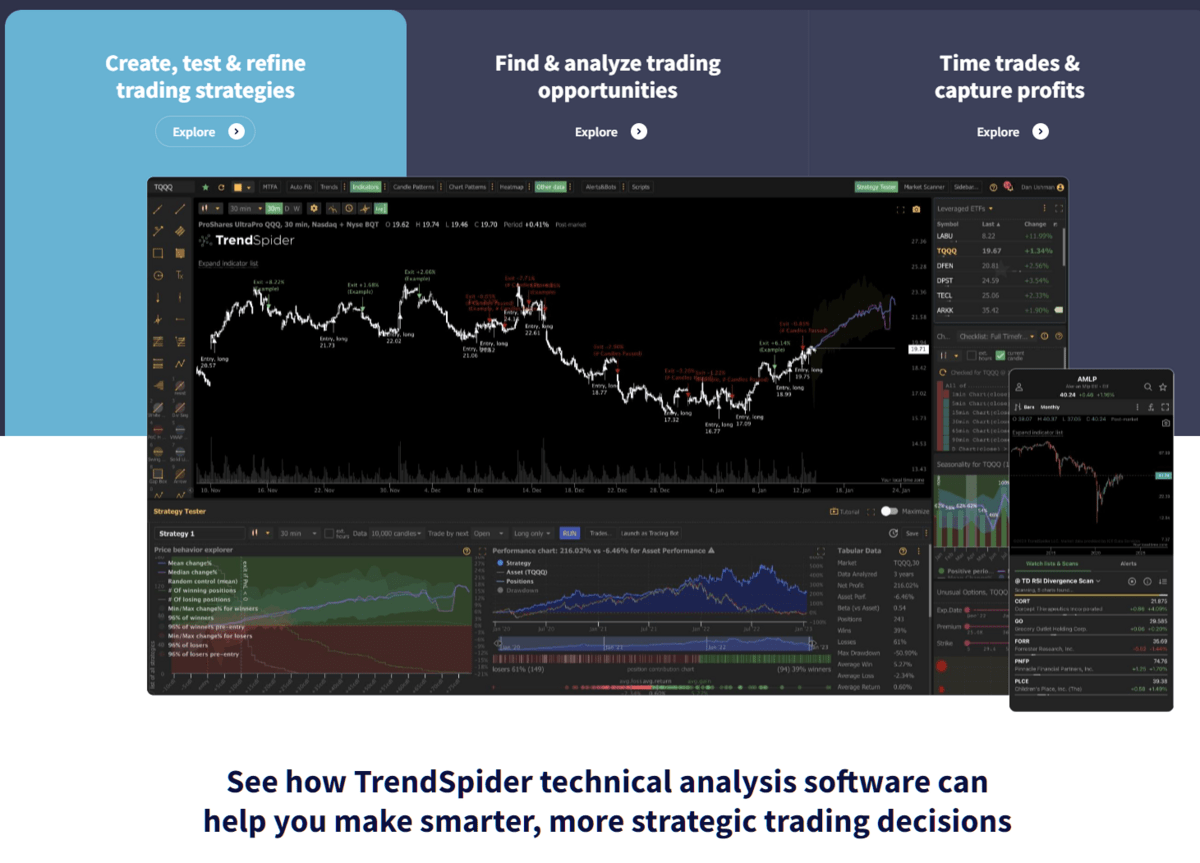

Percentage Allocation Management Module (PAMM) Model

The PAMM model implemented by AGA enables tailored investment management services based on users’ capital allocations. Once authorized by users, the system automatically executes trades and distributes profits according to each investor’s proportion of capital. This personalized approach to investment management ensures efficient and transparent profit-sharing among users, enhancing overall trading experiences.

This image is property of www.wallstreetzen.com.

AGA AI Trading Packages and Rebate Structure

AGA offers a structured rebate system based on trading volume and capital allocation, rewarding users with varying trade rebates:

- Less than 3,000 USD Investment: Trade Rebate of 0.25 USD per lot

- Between 3,000 USD and 30,000 USD Investment: Trade Rebate of 0.28 USD per lot

- More than 30,000 USD Investment: Trade Rebate of 0.30 USD per lot

This rebate structure incentivizes larger capital allocations by providing higher rebates, empowering users to maximize their returns and take advantage of the platform’s revenue-sharing model.

Dual Income Model

AGA offers users a dual income model that consists of two key income streams:

- Profit Sharing: Users receive 50% of the profits generated by the AI trading system, with automated profit distributions upon settlement.

- Trade Rebate: Users earn trade rebates based on their trading volume, with varying rates depending on their fund allocation.

By combining profit-sharing with trade rebates, AGA’s dual income model allows users to optimize their returns and capitalize on both consistent profitability and additional income from trading activities.

This image is property of cdn.analyticsvidhya.com.

Commission Rebate System

Agents working with AGA can earn rebates by referring clients to the platform, with varying rates based on sales volumes:

- 1st Level: 0.08 USD per lot (1,000 – 3,000 USD sales)

- 2nd Level: 0.06 USD per lot (>3,000 USD sales)

- 3rd Level: 0.04 USD per lot (>5,000 USD sales)

- 4th Level: 0.02 USD per lot (>10,000 USD sales)

This commission rebate system incentivizes agent referrals and rewards networking efforts, creating opportunities for agents to generate additional income through client engagement.

Community Rebate System

AGA offers community rebates to reward agents and leaders who contribute to building and maintaining active trading communities. The rebate structure incentivizes community growth and network development, fostering a collaborative environment for users and agents alike.

This image is property of www.wallstreetzen.com.

Revenue Distribution for Trade Rebate

AGA’s revenue distribution model allocates revenue from each lot traded as follows:

- Investor-Trade Rebate: 0.30 USD per lot

- Commission Rebate: 0.20 USD per lot

- Community Rebate: 0.40 USD per lot

- Community Rebate (same ranking): 0.10 USD per lot

- Investor Protection Scheme: 0.01 USD per lot

- AGA AI Revenue: 0.19 USD per lot

This distribution model ensures transparency and accountability in revenue sharing, providing users with clear insights into how profits are generated and distributed within the platform.

Automated Profit Settlement

AGA’s trading system automatically settles trading profits at a specified time each month, with profits distributed according to a predefined ratio:

- AGA Trading Team: 50%

- User: 50%

This automated profit settlement process streamlines profit distribution and ensures timely and accurate processing of earnings for users, enhancing user experience and trust in the platform.

AGA AI Trading Profit Sharing

Profits from trades executed through the AGA AI trading system are split evenly between the AGA Trading Team and the user, highlighting a balanced approach to revenue sharing and collaboration among all parties involved.

Investor Protection Plan

To safeguard users and ensure long-term stability, AGA’s trading platform allocates a portion of each commission to a reserve fund. This Investor Protection Plan covers risks and welfare planning, providing users with additional security and peace of mind as they engage in trading activities.

Transparency and Real-Time Monitoring

AGA offers 24/7 account access for users to monitor trading activities and secure funds in real-time. This transparency and accessibility empower users with the information they need to make informed decisions and actively manage their investment portfolios, reinforcing trust and confidence in the platform.

By leveraging the most powerful features of AGA’s AI trading system, investors can access a cutting-edge platform that combines advanced technology with innovative strategies to maximize profitability, minimize risks, and enhance trading experiences. As the financial landscape continues to evolve, AGA remains at the forefront of AI-driven trading, offering users a competitive edge in today’s dynamic markets.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com