Introduction

In the financial world, the Angel Guardian Alliance (AGA) trading system stands as a beacon of innovation, leveraging AI-driven technologies and quantum algorithms to generate consistent profits while keeping risks at a minimum. This guide will walk you through the best ways to utilize AGA for long-term wealth growth, highlighting key features, strategies, and benefits that can help you navigate the complexities of the trading landscape with confidence.

Understanding AGA’s Purpose

AGA is designed to cater to a diverse global audience, including individual investors, institutional clients, financial professionals, and trading enthusiasts looking for low-risk, high-return opportunities in the market. The system’s objective is clear: to provide a secure, efficient, and transparent trading environment that utilizes AI-powered platforms to achieve zero liquidation risk through ultra-high-frequency trading, risk-free arbitrage, and a dual-income model.

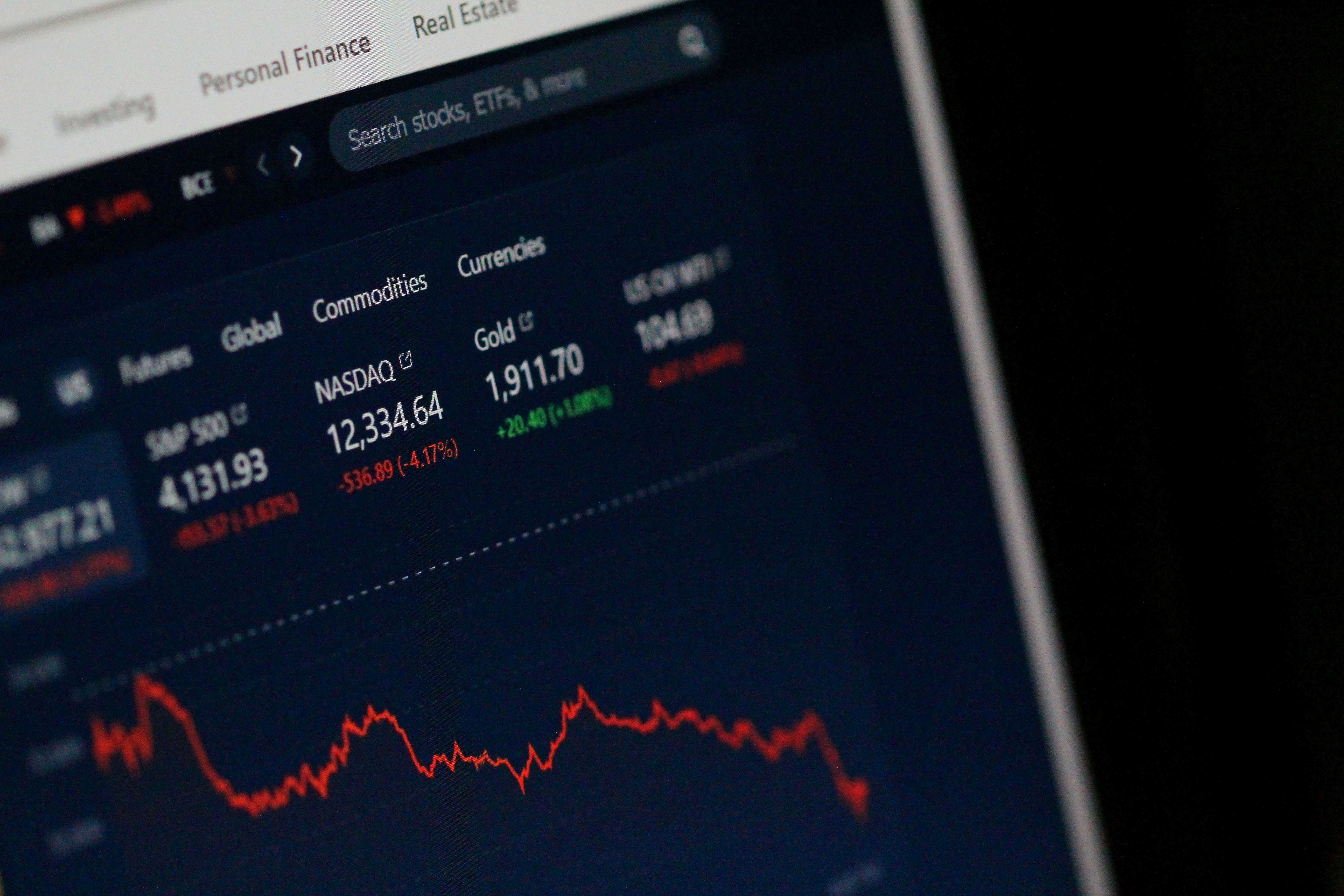

This image is property of images.unsplash.com.

Leveraging AGA’s Key Features

Let’s delve deeper into the core features of the AGA trading system that set it apart and make it an attractive option for those seeking long-term wealth growth opportunities.

AI Quantitative Trading

AGA’s AI quantitative trading system, based on a quantum algorithm, focuses on automating analysis and trading decisions to maximize profitability. By leveraging data-driven insights and market trends, the platform ensures optimal trading outcomes with minimal human intervention.

Zero Liquidation Risk

One of the standout features of AGA is its ability to prevent liquidation by using ultra-high-frequency trading techniques with very short holding times, typically under 30 seconds. This approach guarantees stability and minimizes risks, even in highly volatile market conditions.

Multi-Liquidity Access

AGA grants users access to multiple liquidity providers, ensuring competitive pricing, fast execution, and deep market access. This multi-liquidity model enhances trading efficiency and reduces the impact of market fluctuations on trades.

Risk-Free Arbitrage Opportunities

AGA’s trading system excels in identifying arbitrage opportunities across various markets, allowing investors to profit from price discrepancies without traditional trading risks. This strategy paves the way for a consistent income stream while minimizing risk exposure.

Percentage Allocation Management Module (PAMM) Model

The PAMM model enables AGA to offer tailored investment management services to users. Once authorized, the system can automatically execute trades and distribute profits based on each investor’s capital proportion, streamlining the investment process.

AGA AI Trading Packages and Rebate Structure

AGA’s trading system incentivizes different capital allocations through a structured rebate system based on trading volume. The platform offers varying trade rebates depending on the invested capital range, encouraging larger capital allocations for enhanced returns.

Dual Income Model

AGA implements a dual income model that combines profit sharing and trade rebates for investors. By earning 50% of the profits generated by the AI trading system and additional trade rebates based on trading volume, investors can maximize their returns through multiple income streams.

Commission and Community Rebate Systems

AGA’s commission rebate system rewards agents referring clients based on sales volume, providing multiple levels of rebates for different sales tiers. Additionally, the platform offers community rebates to incentivize network growth and development among community leaders.

Revenue Distribution and Investor Protection Plan

AGA ensures a transparent revenue distribution model for trade rebates, allocating rebates to investors, commissions, community leaders, and welfare planning. This structured approach enhances user confidence and aligns incentives for all stakeholders involved.

Implementing AGA for Long-Term Wealth Growth

Now that we’ve explored AGA’s key features and benefits, let’s discuss practical ways to leverage the platform for long-term wealth growth.

Understanding Profit Generation Mechanisms

AGA’s AI-driven trading system aims to achieve consistent profits through automated analysis, rapid execution, and risk-free strategies. By understanding the mechanisms behind profit generation, investors can make informed decisions and optimize their trading strategies.

Diversifying Investment Portfolios

To maximize long-term wealth growth, it’s essential to diversify investment portfolios across different asset classes and trading strategies. AGA’s multi-liquidity access and risk-free arbitrage opportunities provide avenues for diversification and risk management.

Leveraging Trade Rebates and Profit Sharing

By actively participating in AGA’s trade rebates and profit-sharing programs, investors can enhance their overall returns and maximize income streams. The structured rebate system incentivizes higher capital allocations, while profit sharing ensures investors benefit from the AI trading system’s success.

Building a Strong Community Network

AGA’s community rebate system encourages agents and leaders to build and maintain active trading communities, fostering network growth and development. By leveraging community rebates and network incentives, investors can enhance their trading experience and build lasting relationships within the AGA ecosystem.

Monitoring and Adjusting Trading Strategies

Successful long-term wealth growth requires continuous monitoring and adjustment of trading strategies to adapt to changing market conditions. AGA’s real-time monitoring capabilities and automated profit settlements provide users with the tools to track performance and make informed decisions.

Safeguarding Investments with AGA’s Investor Protection Plan

AGA’s investor protection plan ensures that a portion of each commission contributes to a reserve fund for risk coverage and welfare planning. By safeguarding investments and mitigating potential risks, investors can feel more secure and confident in their long-term wealth growth strategies.

This image is property of images.unsplash.com.

Conclusion

In conclusion, the Angel Guardian Alliance (AGA) offers a robust trading platform that combines AI-driven technologies, risk-free strategies, and innovative features to facilitate long-term wealth growth for investors. By leveraging AGA’s key features, implementing sound trading practices, and actively participating in profit-sharing and rebate programs, investors can navigate the financial markets with confidence and aim for sustainable financial growth.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com