Analyzing Gold Prices on Thursday, October 3

As you navigate the market trends for gold on Thursday, October 3, it is essential to understand the factors influencing the prices of this precious metal. Gold has long been considered a safe haven investment, especially during times of economic uncertainty.

Historical Trends of Gold Prices

When assessing gold prices, it is crucial to look at historical trends to gain a better understanding of how the market has fluctuated over time. Historical data can provide valuable insights into the potential future performance of gold prices.

For instance, historical data may show patterns in gold prices in response to global events, such as geopolitical tensions or changes in central bank policies. By analyzing these trends, you can make more informed decisions when it comes to your investment strategies.

Factors Influencing Gold Prices

Various factors can influence the price of gold on any given day. These factors can include market demand, economic indicators, geopolitical events, and central bank policies. It is essential to consider these factors when evaluating gold prices for Thursday, October 3.

For example, increased demand for gold as a safe haven asset during times of economic uncertainty can drive up prices. Conversely, a stronger U.S. dollar may lead to lower gold prices, as the metal becomes more expensive for buyers in other currencies.

Gold Price Forecast for Thursday

Looking ahead to Thursday, October 3, experts predict that gold prices will continue to be influenced by global economic conditions and market volatility. Keeping an eye on these factors can help you anticipate potential movements in gold prices throughout the day.

It is always advisable to consult with financial experts or analysts to get a more accurate forecast of gold prices on Thursday. Their insights can provide valuable guidance as you navigate the fluctuations in the gold market.

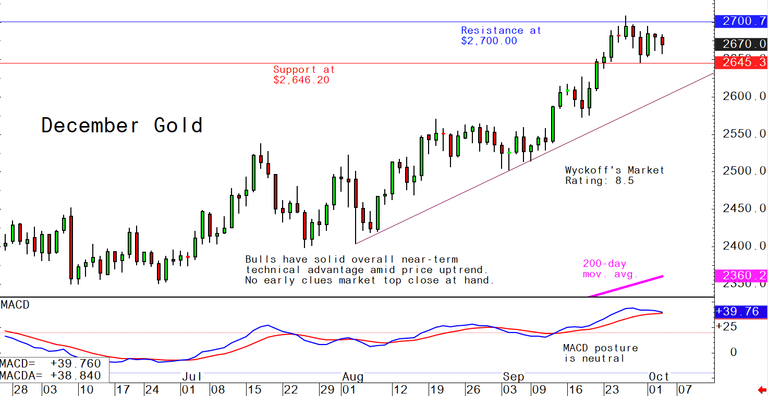

This image is property of images.kitco.com.

Silver, Platinum, and Palladium: Comparing Precious Metal Prices

In addition to gold, silver, platinum, and palladium are also significant players in the precious metals market. These metals each have unique properties and applications, making them valuable commodities for investors and industrial purposes.

Silver: The Versatile Precious Metal

Silver is known for its wide range of applications, from jewelry and silverware to industrial uses in electronics and photography. As a more affordable alternative to gold, silver is often seen as a more accessible option for investors looking to diversify their portfolios.

Silver prices are influenced by many of the same factors as gold, including market demand, economic indicators, and global events. Investing in silver can offer a way to hedge against market volatility and economic uncertainty.

Platinum: The Rarest Precious Metal

Platinum is one of the rarest precious metals, making it a highly sought-after commodity for investors and industrial applications. Its scarcity and durability have contributed to its value as a symbol of luxury and prestige.

Platinum prices are typically higher than gold and silver, reflecting its rarity and unique properties. As with other precious metals, platinum prices can be influenced by supply and demand dynamics, as well as changes in industrial usage and investor sentiment.

Palladium: The Industrial Metal

Palladium is primarily used in catalytic converters for cars, making it a vital metal in the automotive industry. Its unique properties make it an essential component in reducing harmful emissions from vehicles.

Palladium prices are closely tied to the automotive industry, as well as factors affecting supply and demand. As a key industrial metal, palladium plays a significant role in global manufacturing and emissions reduction efforts.

Comparing Market Performance: Gold, Silver, Platinum, and Palladium

As you evaluate the performance of gold, silver, platinum, and palladium in the market, it is essential to consider a range of factors that can influence their prices and demand. Understanding the unique dynamics of each precious metal can help you make informed decisions about your investment strategy.

Market Volatility and Safe Haven Assets

During times of market volatility and economic uncertainty, investors often turn to safe haven assets like gold and silver as a way to protect their wealth. These precious metals are seen as reliable stores of value, offering stability in turbulent market conditions.

Platinum and palladium, on the other hand, are more closely tied to industrial demand, particularly in the automotive industry. The performance of these metals can be influenced by factors affecting global manufacturing, emissions regulations, and technological advancements.

Investment Diversification and Portfolio Management

Investing in a mix of precious metals can help diversify your portfolio and reduce risk exposure to any single asset or sector. Gold, silver, platinum, and palladium each have unique properties and applications that can offer a hedge against inflation, currency fluctuations, and geopolitical events.

By carefully balancing your investment in these precious metals, you can create a well-rounded portfolio that is resilient to market fluctuations and economic challenges. Consult with financial advisors or analysts to develop a strategic investment plan that aligns with your financial goals and risk tolerance.

The Role of Central Banks and Monetary Policy

Central banks play a significant role in influencing the prices of precious metals through their monetary policies and interest rate decisions. Changes in central bank policies can impact the value of currencies, inflation rates, and overall market sentiment towards gold, silver, platinum, and palladium.

Keep an eye on central bank announcements and economic indicators that may signal shifts in monetary policy. These factors can have a ripple effect on precious metal prices, creating opportunities for investors to adjust their strategies accordingly.

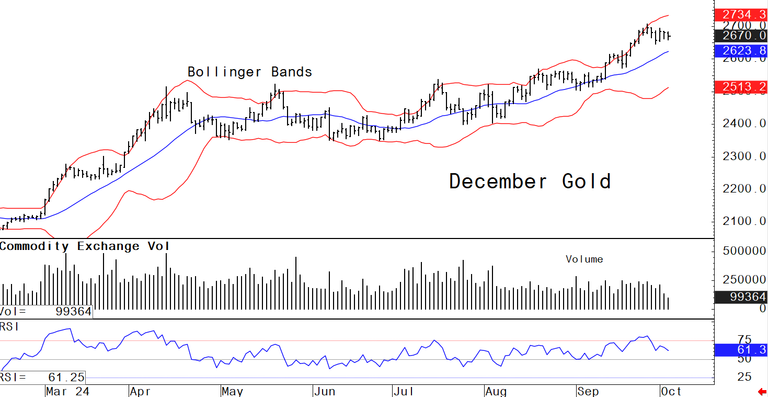

This image is property of images.kitco.com.

Conclusion

As you navigate the market trends for gold, silver, platinum, and palladium on Thursday, October 3, it is essential to stay informed about the factors influencing their prices and demand. Each of these precious metals offers unique opportunities for investors to diversify their portfolios and hedge against market volatility.

By analyzing historical trends, evaluating market performance, and understanding the role of central banks, you can make more informed decisions about your investment strategies. Consult with financial experts or analysts to get a more accurate forecast of precious metal prices and develop a comprehensive investment plan that aligns with your financial goals.

Remember to stay updated on global events, economic indicators, and industry developments that may impact the prices of gold, silver, platinum, and palladium. With a strategic approach and a keen awareness of market dynamics, you can navigate the precious metals market with confidence and resilience.