“What Are the Different Forms of Gold Investments? 6 Must-Know Types”

This image is property of www.physicalgold.com.

Overview of Gold Investments

Gold has long been considered a valuable commodity and a safe investment option. There are various forms of gold investments available to investors, each with its own unique characteristics and benefits. Understanding the different types of gold investments can help you make informed decisions and diversify your investment portfolio effectively.

Physical Gold Investments

Physical gold investments involve owning gold in the form of bullion, coins, or bars. These physical assets can be held personally or stored in secure vaults. This form of investment provides tangible ownership of gold and allows investors to benefit from its intrinsic value.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) are investment funds that track the price of gold and are traded on major stock exchanges. Investing in gold ETFs provides exposure to the gold market without the need for physical storage. These funds offer liquidity and flexibility for investors looking to trade gold.

Gold Stocks

Investing in gold mining companies or shares of gold-related companies is another way to gain exposure to the gold market. Gold stocks are influenced by both the price of gold and the company’s performance. This form of investment allows investors to participate in the growth potential of gold mining operations.

Gold Futures and Options

Gold futures and options are financial derivatives that allow investors to speculate on the future price of gold. These investment instruments provide leverage and enable traders to hedge against price fluctuations. Gold futures and options offer the potential for high returns but also come with high risk.

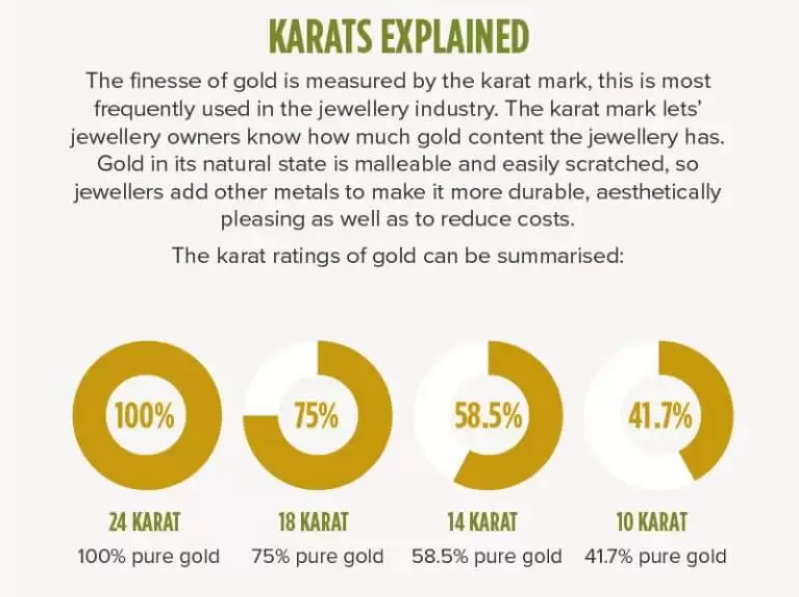

Gold Jewelry

Investing in gold jewelry involves purchasing gold ornaments for personal use or as an investment. Gold jewelry can be a valuable asset if the price of gold increases over time. However, the value of gold jewelry may be affected by craftsmanship and design, in addition to the gold content.

Gold Savings Accounts

Gold savings accounts are offered by banks and financial institutions, allowing investors to buy and hold gold in a digital form. These accounts provide convenience and security for investors looking to invest in gold without physical ownership. Gold savings accounts may offer competitive interest rates or fee structures.

Comparison of Different Gold Investments

| Type of Gold Investment | Pros | Cons |

|---|---|---|

| Physical Gold | Tangible ownership, intrinsic value | Storage costs, security risks |

| Gold ETFs | Liquidity, diversification | Management fees, market risk |

| Gold Stocks | Growth potential, dividends | Company performance, stock market volatility |

| Gold Futures/Options | Leverage, hedging | High risk, price volatility |

| Gold Jewelry | Wearable, aesthetic value | Craftsmanship, design influences |

| Gold Savings Accounts | Digital ownership, convenience | Interest rates, financial risk |

This image is property of www.quantifiedstrategies.com.

Factors to Consider When Investing in Gold

When choosing the right form of gold investment for your portfolio, it is essential to consider various factors such as your investment goals, risk tolerance, liquidity needs, and time horizon. Each type of gold investment has its own set of advantages and disadvantages, so understanding these factors can help you make informed decisions and optimize your investment strategy.

Investment Goals

Consider whether you are investing in gold for capital appreciation, portfolio diversification, wealth preservation, or inflation protection. Your investment goals will influence the type of gold investment that best suits your objectives.

Risk Tolerance

Evaluate your risk tolerance and financial capacity to bear potential losses. Some forms of gold investments, such as gold futures and options, may carry higher risk due to leverage and price volatility.

Liquidity Needs

Determine how quickly you may need to access your investment or convert it into cash. Gold ETFs and gold savings accounts offer high liquidity compared to physical gold investments.

Time Horizon

Consider your investment time horizon and whether you are looking for short-term gains or long-term wealth accumulation. Different forms of gold investments may be more suitable based on your time horizon.

Market Conditions

Monitor economic indicators, geopolitical events, and interest rate movements that may impact the price of gold. Stay informed about market trends and factors that influence the gold market to make timely investment decisions.

This image is property of cdn.prod.website-files.com.

Conclusion

In conclusion, there are various forms of gold investments available to investors, each offering unique benefits and considerations. By understanding the different types of gold investments, you can diversify your portfolio, hedge against risks, and capitalize on the stability and profitability of gold as an asset class. Whether you choose physical gold, gold ETFs, gold stocks, gold futures, gold jewelry, or gold savings accounts, it is essential to conduct thorough research, assess your investment goals, and consult with financial advisors to make well-informed investment decisions. Start exploring the world of gold investments today and unlock the potential for financial growth and stability in your investment portfolio.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com