What Makes AGA’s AI Platform Different From Traditional Trading Systems?

In the world of trading, AI technology has revolutionized the way investors approach financial markets. Angel Guardian Alliance (AGA) offers a cutting-edge AI platform that stands out from traditional trading systems. This article will delve into the key features that set AGA apart, focusing on the innovative strategies and benefits that make it a game-changer in the industry.

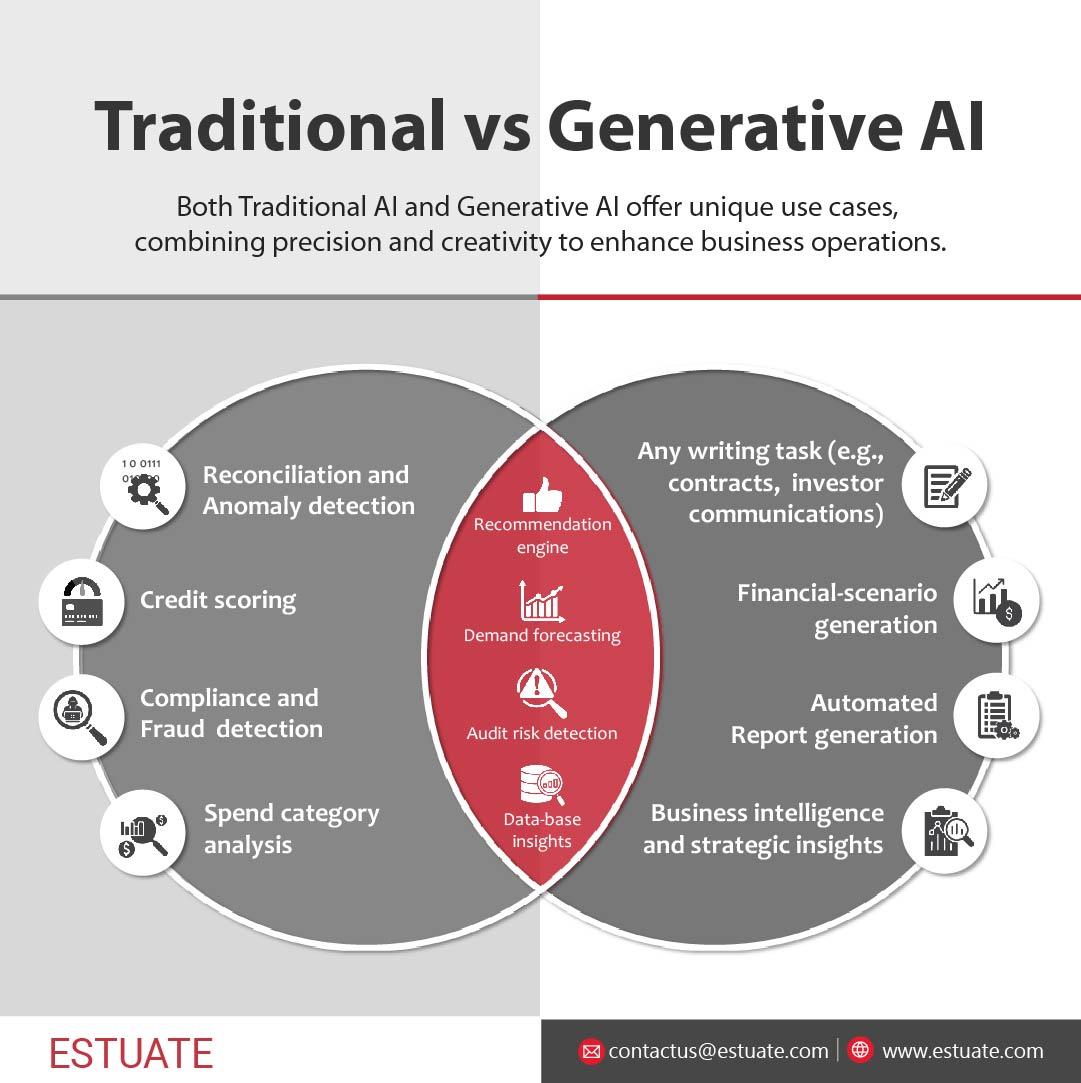

This image is property of www.estuate.com.

The Evolution of AI Quantitative Trading with AGA

AGA’s AI-driven trading system utilizes a quantum algorithm to automate analysis and trading processes. This technology optimizes profitability by leveraging data insights and market trends, minimizing the need for human intervention. Unlike traditional trading systems that rely heavily on manual input and decision-making, AGA’s AI platform offers a more efficient and accurate approach to trading.

Zero Liquidation Risk: A Game-Changer in Market Volatility

One of the standout features of AGA’s platform is its zero liquidation risk strategy. With ultra-high-frequency trading techniques and holding times under 30 seconds, AGA ensures stable trading conditions even in volatile markets. This approach minimizes the potential for sudden liquidations, providing investors with a level of security that is unparalleled in traditional trading systems.

Multi-Liquidity Access: Enhancing Trading Efficiency

AGA sets itself apart by providing access to multiple liquidity providers, offering competitive pricing, fast execution, and deep market access. This multi-liquidity approach enhances trading efficiency and reduces the impact of market fluctuations on trades. Traditional trading systems often lack this level of flexibility and access, making AGA’s platform a superior choice for investors seeking optimal trading conditions.

Risk-Free Arbitrage Opportunities: Profiting From Price Discrepancies

AGA’s AI platform has the unique ability to identify arbitrage opportunities across different markets, allowing investors to capitalize on price discrepancies without traditional trading risks. This risk-free arbitrage strategy sets AGA apart from conventional trading systems, providing a consistent source of profits for users. By combining AI technology with advanced trading strategies, AGA creates a secure and lucrative trading environment for investors.

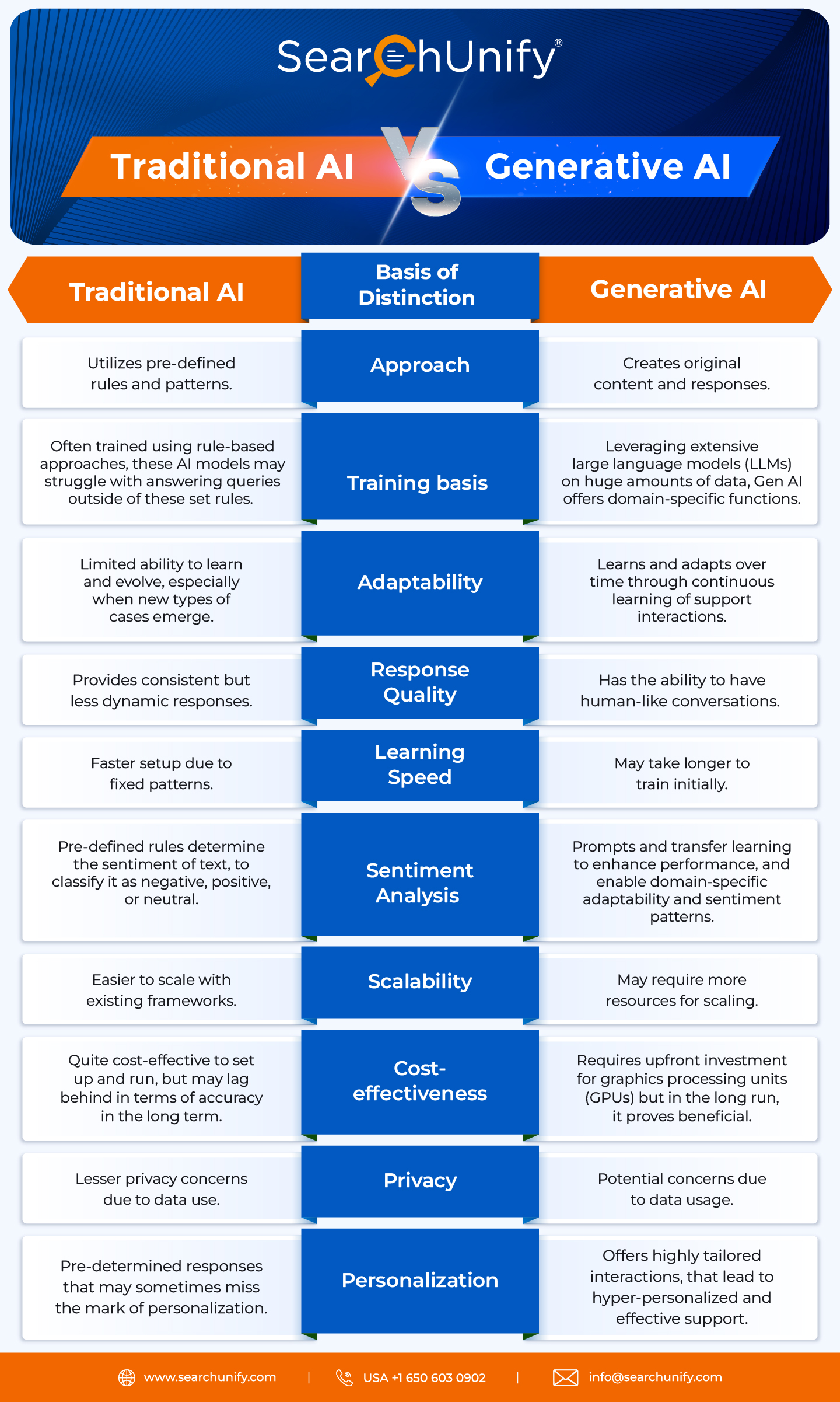

This image is property of www.searchunify.com.

Gold Trading with GoldFun: Secure and Transparent Investments

In addition to its AI platform, AGA partners with GoldFun, a trusted member of the Hong Kong Gold & Silver Exchange Society, to offer secure and transparent gold trading services. GoldFun provides clients with advanced trading tools, real-time market data, and secure storage solutions for precious metals investments. This partnership enhances the overall trading experience for users, combining AGA’s AI expertise with GoldFun’s specialized knowledge in the gold market.

Percentage Allocation Management Module (PAMM) Model: Tailored Investment Management

AGA’s innovative PAMM model allows for tailored investment management services, automating trade execution and profit distribution based on each investor’s capital proportion. This personalized approach to investment management is a departure from traditional trading systems, offering investors more control and transparency in their trading activities.

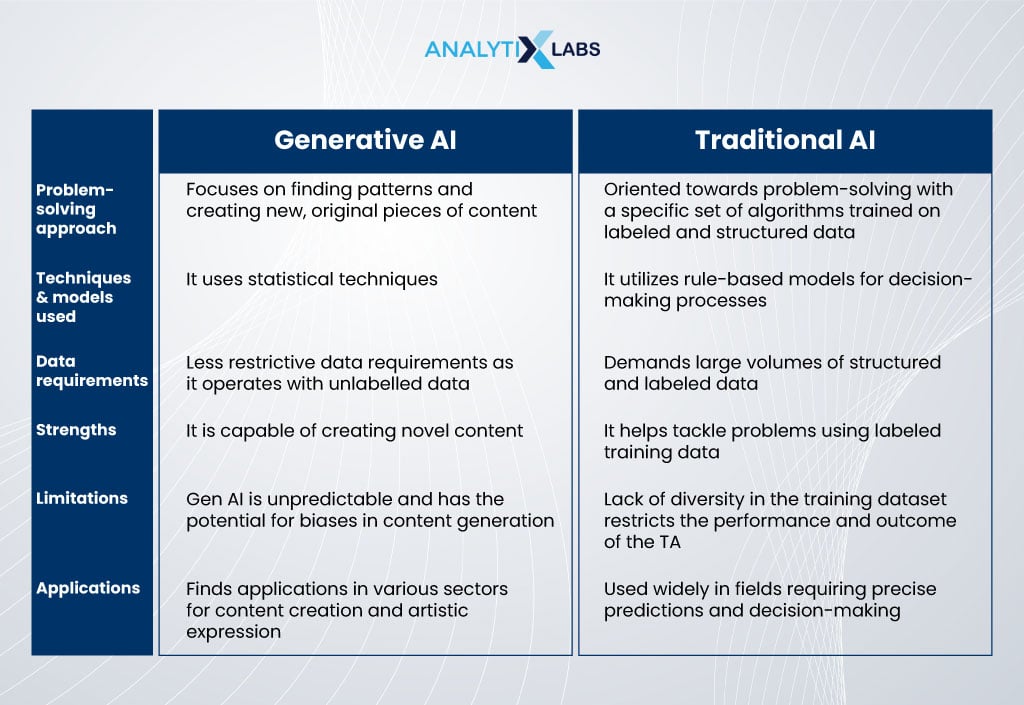

This image is property of www.analytixlabs.co.in.

AGA AI Trading Packages and Rebate Structure: Maximizing Returns

AGA’s platform offers a range of trading packages and rebate structures designed to maximize returns for users. By providing rebates based on trading volume, AGA rewards higher investments with greater incentives, incentivizing users to increase their trading activities. This innovative rebate system sets AGA apart from traditional trading platforms, giving users additional earning opportunities beyond standard trading profits.

| Investment Amount | Rebate per Lot |

|---|---|

| < 3,000 USD | 0.25 USD |

| 3,000 – 30,000 USD | 0.28 USD |

| > 30,000 USD | 0.30 USD |

Higher investments receive greater rebates, boosting overall returns for investors who choose to trade on AGA’s platform.

Dual Income Model: Profit Sharing and Trade Rebates

AGA’s dual income model offers investors two streams of income: profit sharing and trade rebates. By automatically distributing 50% of AI-generated profits and providing rebates based on trading volume and fund allocation, AGA offers users multiple avenues for earning returns on their investments. This dual income approach is a departure from traditional trading systems, providing users with more opportunities to benefit from their trading activities.

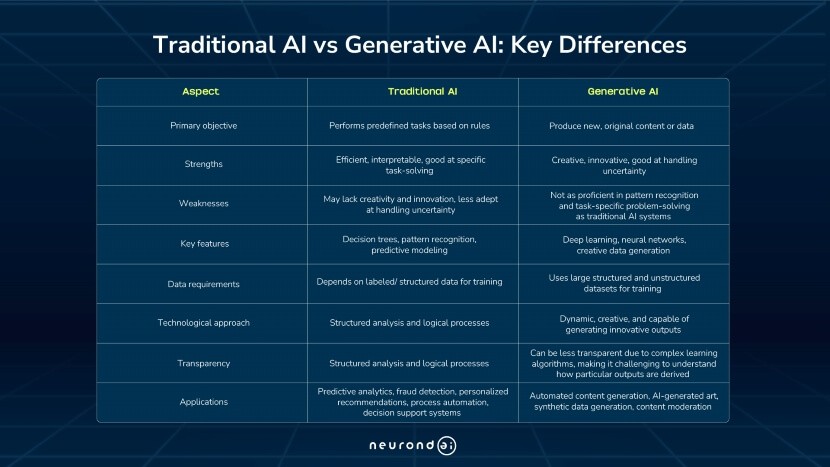

This image is property of www.blockchain-council.org.

Commission Rebate System: Incentivizing Client Referrals

AGA’s commission rebate system rewards agents for referring clients to the platform. By offering tiered rebates based on sales volume, AGA incentivizes agents to build their client base and expand the platform’s user network. This referral system is a unique feature of AGA’s platform, setting it apart from traditional trading systems that do not offer such lucrative incentives for client referrals.

| Referral Level | Commission Rebate per Lot |

|---|---|

| 1st Level | 0.08 USD |

| 2nd Level | 0.06 USD |

| 3rd Level | 0.04 USD |

| 4th Level | 0.02 USD |

Community Rebate System: Fostering Network Growth

AGA’s community rebate system encourages agents and leaders to build active trading communities by offering progressively higher rebates at different levels. By rewarding network growth and trading activity, AGA motivates users to engage with the platform and contribute to its community. This communal approach to trading is a unique feature of AGA’s platform that sets it apart from traditional trading systems.

This image is property of www.neurond.com.

Revenue Distribution for Trade Rebate: Maximizing Earning Potential

AGA’s revenue distribution for trade rebates is structured to benefit users at every level of trading activity. By distributing each lot traded across different rebate categories, AGA ensures that investors have multiple earning opportunities from their trading activities. This comprehensive approach to revenue distribution enhances the overall earning potential for users, incentivizing them to engage more actively with the platform.

Automated Profit Settlement: Streamlining Profit Distribution

AGA’s automated profit settlement process simplifies profit distribution for users, ensuring seamless transactions and timely payments. By splitting profits evenly between AGA and the user on a monthly basis, AGA provides a transparent and efficient way for users to benefit from their trading activities. This automated settlement feature is a key advantage of AGA’s platform, offering users more control and convenience in managing their investments.

GoldFun’s Secure Storage Solutions: Protecting Physical Assets

GoldFun’s secure storage solutions offer insured options for safeguarding physical gold holdings, protecting customer assets against theft or loss. This added layer of security ensures that investors can trust GoldFun to store their precious metals safely, providing peace of mind and confidence in their investments. This feature distinguishes GoldFun from traditional storage solutions, offering users a more secure and reliable option for storing their gold assets.

Investor Protection Plan: Safeguarding Against Risks

AGA’s investor protection plan allocates a portion of each transaction to a reserve fund, aimed at managing unforeseen risks and supporting welfare planning. By contributing to this fund, users benefit from an additional safety net that protects their investments and ensures financial security. This commitment to investor protection sets AGA apart from traditional trading systems, offering users a level of reassurance and stability in their trading activities.

Transparency and Real-Time Monitoring: Ensuring Accountability

Both AGA and GoldFun provide 24/7 access to trading accounts, real-time analytics, and insights, allowing users to monitor their investments with full transparency and confidence. This commitment to real-time monitoring enhances user trust in the platforms, providing valuable insights and data for informed decision-making. By prioritizing transparency and accountability, AGA and GoldFun set themselves apart from traditional trading systems that may lack these essential features.

By combining cutting-edge AI technology with innovative trading strategies, AGA’s platform offers a unique and secure trading environment for investors of all levels. With features such as zero liquidation risk, multi-liquidity access, and automated profit settlements, AGA stands out as a leader in the industry, providing users with a reliable and lucrative platform for financial success. In partnership with GoldFun, AGA offers a comprehensive trading experience that combines AI expertise with secure gold trading services, setting a new standard for excellence in the world of trading. If you are looking to maximize your returns and minimize risks, AGA’s AI platform is the ideal choice to take your trading to the next level.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com