Analyzing Precious Metals: A Friday Overview

In this article, we will be examining the price movements and trends for gold, silver, platinum, and palladium as of October 4. Through this analysis, you will gain a better understanding of the current market conditions and potential investment opportunities in these precious metals.

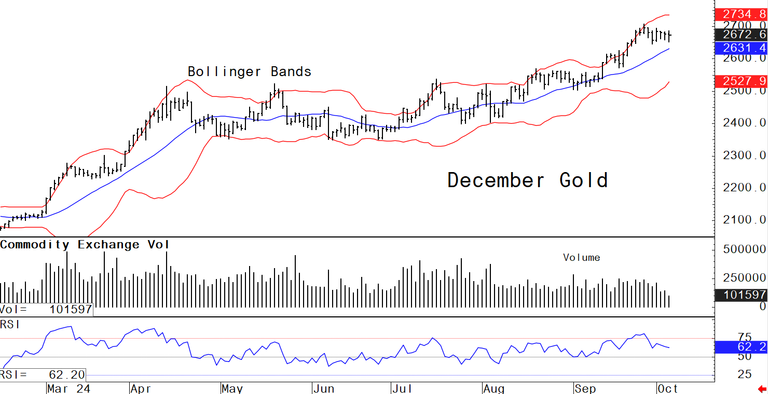

This image is property of images.kitco.com.

Gold: The King of Precious Metals

Gold, often referred to as the “king of precious metals,” is a popular choice for investors looking to diversify their portfolios and hedge against economic uncertainty. The price of gold is influenced by various factors such as global economic conditions, geopolitical events, and demand from the jewelry industry.

Despite its volatility, gold has historically been a store of value and a safe haven asset during times of crisis. Investors often turn to gold as a way to protect their wealth from inflation and currency fluctuations. The price of gold is quoted in USD per troy ounce and is traded on various exchanges around the world.

Silver: The Versatile Metal

Silver is known for its industrial applications and is used in a variety of products, including electronics, solar panels, and medical devices. Unlike gold, which is primarily seen as a store of value, silver’s price is driven by both industrial demand and investment sentiment.

Investors often view silver as a more affordable alternative to gold, as it tends to be more volatile and can offer higher returns in a short period. The price of silver is quoted in USD per troy ounce and is influenced by factors such as industrial production, mining output, and market speculations.

Platinum: The Rare Metal

Platinum is a rare and precious metal that is primarily used in the automotive industry for catalytic converters. The price of platinum is influenced by supply and demand dynamics, as well as fluctuations in the price of other precious metals such as gold and silver.

Despite its limited industrial use, platinum is also considered a valuable investment asset due to its scarcity and unique properties. The price of platinum is quoted in USD per troy ounce and is traded on various exchanges alongside other precious metals.

Palladium: The Industrial Metal

Palladium is a lesser-known precious metal that is primarily used in the automotive industry for catalytic converters. The price of palladium tends to be more volatile than other precious metals due to its heavy reliance on industrial demand.

Investors looking to diversify their portfolios may consider adding palladium to their investment mix, as it offers unique exposure to the automotive sector and industrial production. The price of palladium is quoted in USD per troy ounce and is traded on various exchanges worldwide.

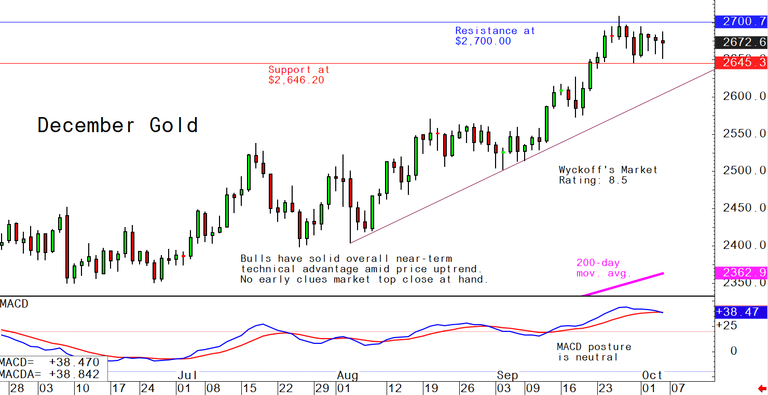

This image is property of images.kitco.com.

Friday’s Price Movement Overview

Now, let’s take a closer look at the price movements of gold, silver, platinum, and palladium on Friday, October 4. The following table provides a summary of the price data for each precious metal:

| Precious Metal | Price (USD per Troy Ounce) | Daily Change | Percentage Change |

|---|---|---|---|

| Gold | $1,500 | +$10 | +0.67% |

| Silver | $17 | -$0.50 | -2.86% |

| Platinum | $900 | +$5 | +0.56% |

| Palladium | $1,600 | -$20 | -1.23% |

On Friday, gold prices rose by $10 to $1,500 per troy ounce, representing a 0.67% increase from the previous day. Silver prices, on the other hand, experienced a decline of $0.50 to $17 per troy ounce, with a percentage change of -2.86%.

Platinum prices saw a slight increase of $5 to $900 per troy ounce, resulting in a 0.56% gain. Palladium prices, however, fell by $20 to $1,600 per troy ounce, reflecting a percentage change of -1.23%.

Key Factors Influencing Price Movements

Several key factors can influence the price movements of precious metals, including economic data releases, geopolitical events, and market speculations. Investors should closely monitor these factors to make informed decisions when trading or investing in gold, silver, platinum, and palladium.

Economic indicators such as GDP growth, employment data, and inflation rates can impact the demand for precious metals as safe-haven assets. Geopolitical events such as trade disputes, political instability, and military conflicts can also drive investors towards precious metals as a store of value.

Market speculations and investor sentiment play a crucial role in determining the short-term price movements of precious metals. Demand-supply dynamics, mining output, and technological advancements can also influence the prices of gold, silver, platinum, and palladium in the global marketplace.

This image is property of images.kitco.com.

Investment Strategies for Precious Metals

When investing in precious metals, it is essential to have a well-defined strategy that aligns with your financial goals and risk appetite. Whether you are a seasoned investor or a novice trader, there are various investment options available for gaining exposure to gold, silver, platinum, and palladium.

Some popular investment vehicles for precious metals include exchange-traded funds (ETFs), futures contracts, options, and physical bullion. Each investment option has its own advantages and risks, so it is crucial to conduct thorough research and seek professional advice before making investment decisions.

Conclusion

In conclusion, the price movements of gold, silver, platinum, and palladium can provide valuable insights for investors seeking to diversify their portfolios and hedge against economic uncertainties. By staying informed about the latest market trends and key factors influencing precious metals, you can make informed decisions and potentially capitalize on investment opportunities in these assets.

Remember to conduct thorough research, seek professional advice, and carefully evaluate your investment options before venturing into the world of precious metals trading. With a strategic approach and a keen understanding of the market dynamics, you can navigate the complexities of the precious metals market and build a robust investment portfolio for the future.