Analyzing Gold, Silver, and AUD/USD Technical Analysis Ahead of US Nonfarm Payrolls

As an investor or trader in the foreign exchange market, you understand the importance of keeping up with technical analysis to make informed decisions. In this article, we will delve into the technical analysis of three major currencies – Gold, Silver, and the AUD/USD pair – ahead of the US Nonfarm Payrolls report. By the end of this article, you will have a clearer understanding of the current trends and potential movements in these markets.

Gold Technical Analysis

Gold is often considered a safe-haven asset, especially during times of economic uncertainty. Let’s take a closer look at the technical analysis of Gold to understand where it might be headed in the near future.

Gold has been trading in a narrow range between $1750 and $1800 for the past few weeks, indicating a period of consolidation. The 50-day moving average (MA) and the 200-day MA are both sloping upwards, suggesting a bullish sentiment in the market. However, the Relative Strength Index (RSI) is approaching overbought levels, which could indicate a potential reversal in the short term.

This image is property of assets.faireconomy.media.

Silver Technical Analysis

Similar to Gold, Silver is also considered a safe-haven asset with strong industrial demand. Let’s analyze the technical indicators of Silver to determine its potential direction.

Silver has been trading within a range of $25 to $28, showing signs of consolidation. The 50-day MA is above the 200-day MA, indicating a bullish trend. However, the RSI is currently in overbought territory, suggesting a possible correction in the near future. Traders should pay close attention to key support and resistance levels for potential trading opportunities.

This image is property of assets.faireconomy.media.

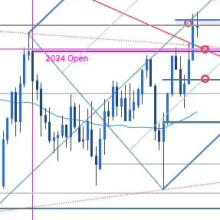

AUD/USD Technical Analysis

The AUD/USD currency pair is often referred to as the ‘Aussie,’ and it is heavily influenced by commodity prices and the overall risk sentiment in the market. Let’s examine the technical analysis of AUD/USD to gain insights into its potential movements.

The AUD/USD pair has been trending higher, reaching a multi-year high recently. The 50-day MA is above the 200-day MA, signaling a strong bullish trend. The RSI is in overbought territory, which could suggest a possible pullback or consolidation in the near term. Traders should be mindful of key support and resistance levels to make informed trading decisions.

This image is property of assets.faireconomy.media.

US Nonfarm Payrolls Impact

The US Nonfarm Payrolls report is a key economic indicator that measures the number of jobs added or lost in the US economy. This report can have a significant impact on the financial markets, including currencies, stocks, and commodities. Let’s explore how the upcoming Nonfarm Payrolls report could influence the markets.

Traders and investors are eagerly awaiting the US Nonfarm Payrolls report to gauge the health of the US labor market. A better-than-expected NFP figure could boost the US Dollar and lead to a sell-off in safe-haven assets like Gold and Silver. Conversely, a weaker-than-expected NFP report could weaken the US Dollar and benefit safe-haven assets.

This image is property of assets.faireconomy.media.

Trading Strategies

As a trader in the forex market, it is crucial to have a well-defined trading strategy to navigate the volatility and uncertainty. Let’s discuss some trading strategies that you can consider when trading Gold, Silver, and the AUD/USD pair.

-

Trend Following: One popular strategy is to follow the trend by buying assets that are rising and selling assets that are falling. This strategy works well in markets with clear trends like Gold and Silver.

-

Support and Resistance Levels: Another strategy is to trade based on key support and resistance levels. By identifying these levels, you can enter or exit trades with more confidence.

-

Risk Management: It is essential to have a proper risk management plan in place to protect your capital. Determine your risk tolerance and set stop-loss orders to limit your losses.

This image is property of assets.faireconomy.media.

Conclusion

In conclusion, analyzing the technical indicators of Gold, Silver, and the AUD/USD pair can provide valuable insights into potential market movements. By understanding the current trends and key levels, you can make more informed trading decisions. Remember to stay updated on economic events like the US Nonfarm Payrolls report to anticipate market volatility. Happy trading!