Understanding Market Fluctuations

As an investor, navigating the ups and downs of the market can be challenging. Understanding how market fluctuations work and impact your investments is crucial for making informed decisions. In this section, we will discuss the factors that contribute to market fluctuations and how they can affect your investment portfolio.

Factors Influencing Market Fluctuations

Market fluctuations can be influenced by a variety of factors, both internal and external. Internal factors may include company performance, industry trends, or economic indicators, while external factors can range from global events to political decisions. It’s essential to stay informed and analyze these factors to anticipate market movements.

Impact of Market Fluctuations on Investments

Market fluctuations can have a significant impact on your investments, affecting the value of your portfolio and potential returns. During a market downturn, the value of most assets tends to decrease, leading to potential losses for investors. Understanding how market fluctuations can affect your investments will help you develop strategies to mitigate risks and protect your wealth.

This image is property of goldsilvershop24.com.

Gold as a Safe Haven Investment

Gold has long been considered a safe haven investment, particularly during times of market volatility. Its inherent value and scarcity make it a popular choice for investors looking to diversify their portfolios and hedge against economic uncertainty. In this section, we will explore how gold can protect your investments from market fluctuations.

Why Invest in Gold?

Gold has been valued for centuries for its intrinsic properties, making it a reliable store of wealth. Unlike fiat currencies or stocks, gold is not subject to inflation or devaluation, providing a stable investment option. During times of economic instability, gold prices tend to rise, offering a hedge against currency fluctuations and financial crises.

How GoldFun Protects Your Investments

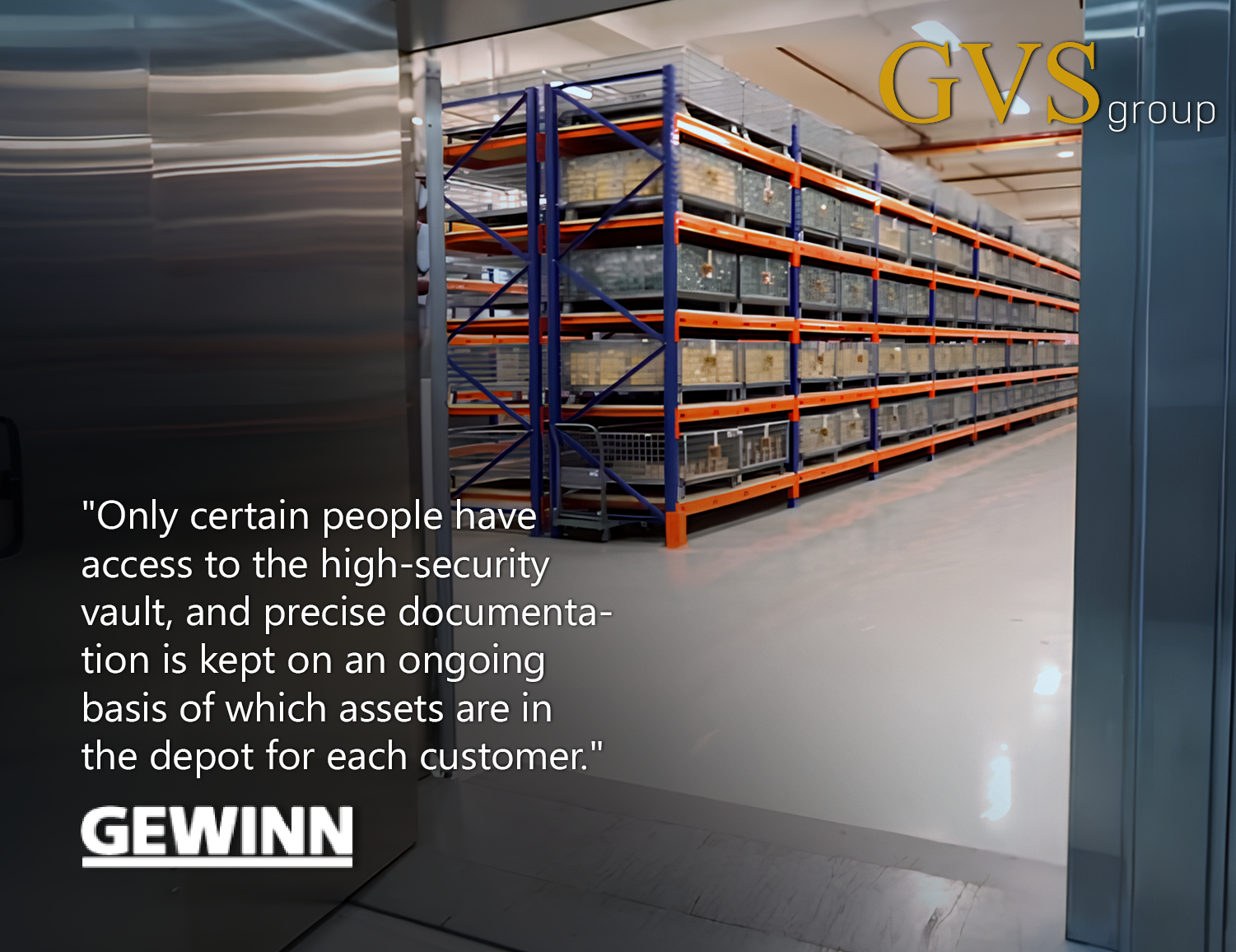

GoldFun offers secure storage solutions for physical gold holdings, ensuring that your assets are protected from market fluctuations and external risks. By storing your gold in insured facilities, you safeguard your investments against theft, loss, or damage. This secure storage option allows you to preserve the value of your gold holdings and minimize potential risks.

Maximizing Returns with GoldFun and AGA

Combining GoldFun’s secure storage solutions with AGA’s AI-driven trading platform can offer a comprehensive approach to maximizing returns while minimizing risks. By leveraging the benefits of both platforms, investors can access innovative trading strategies and secure investment options. In this section, we will discuss how GoldFun and AGA can work together to optimize investment outcomes.

Integrating GoldFun’s Secure Storage

Integrating GoldFun’s secure storage solutions into your investment strategy provides an added layer of protection for your assets. By diversifying holdings into physical gold, investors can reduce exposure to market volatility and preserve capital. GoldFun’s insured storage options ensure that your gold holdings are safe and secure, mitigating potential risks associated with market fluctuations.

Leveraging AGA’s AI Trading Platform

AGA’s AI-driven trading platform offers advanced quantitative trading techniques, allowing investors to capitalize on market opportunities with minimal risk exposure. By utilizing AGA’s zero liquidation risk and risk-free arbitrage strategies, investors can achieve consistent profits while navigating market fluctuations. The platform’s multi-liquidity access and PAMM model further enhance trading efficiency and profitability.

Implementing Dual Income Strategies

By combining GoldFun’s secure storage solutions with AGA’s AI trading platform, investors can implement dual income strategies to optimize returns. AGA’s profit-sharing and trade rebate structures provide additional revenue streams, while GoldFun’s storage options safeguard investments against market risks. This integrated approach offers a comprehensive solution for investors seeking to maximize returns and protect their wealth.

This image is property of securestorage-solutions.com.

Conclusion

Navigating market fluctuations and protecting your investments requires a strategic approach that combines innovative trading platforms with secure storage solutions. By leveraging GoldFun’s insured storage options and AGA’s AI-driven trading platform, investors can access a comprehensive suite of tools to optimize returns while minimizing risks. Understanding how market fluctuations impact your investments and implementing proactive strategies will empower you to navigate volatile market conditions with confidence and resilience.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com