Introduction

In the ever-evolving world of financial markets, investors are constantly seeking innovative strategies to maximize returns while minimizing risks. The Angel Guardian Alliance (AGA) AI trading platform offers a unique approach to trading, leveraging cutting-edge technology and advanced algorithms to generate consistent profits for investors. This article will delve into the top strategies for investing in AGA’s AI trading platform, exploring key features, benefits, and practical tips to help you navigate the world of AI-driven trading.

This image is property of d2908q01vomqb2.cloudfront.net.

Understanding AGA’s AI Quantitative Trading System

AGA’s AI quantitative trading system is the backbone of its platform, utilizing a quantum algorithm to automate analysis and trading decisions. By leveraging data-driven insights and market trends, AGA ensures optimal trading outcomes with minimal human intervention. This sophisticated system maximizes profitability while minimizing risks, offering a competitive edge in today’s fast-paced financial markets.

Zero Liquidation Risk with Ultra-High-Frequency Trading

One of the key advantages of AGA’s trading platform is its zero liquidation risk strategy. By employing ultra-high-frequency trading techniques with holding times under 30 seconds, AGA ensures stability and minimizes risks, even in volatile market conditions. This innovative approach safeguards investors’ capital and provides a secure trading environment for optimal performance.

Harnessing Multi-Liquidity Access for Competitive Trading

AGA’s multi-liquidity access feature provides investors with access to multiple liquidity providers, ensuring competitive pricing, fast execution, and deep market access. This approach enhances trading efficiency and reduces the impact of market fluctuations on trades, allowing investors to capitalize on opportunities in various market conditions.

Capitalizing on Risk-Free Arbitrage Opportunities

AGA’s AI trading system identifies arbitrage opportunities across different markets, allowing investors to generate profits from price discrepancies without traditional trading risks. This risk-free arbitrage strategy contributes to a consistent income stream with minimized exposure to market volatility, offering a lucrative avenue for investors seeking stable returns.

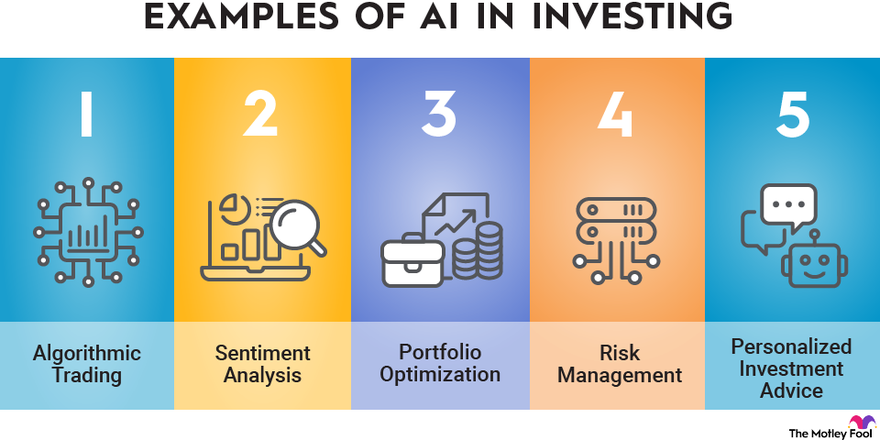

This image is property of m.foolcdn.com.

Leveraging the Percentage Allocation Management Module (PAMM) Model

The Percentage Allocation Management Module (PAMM) model allows AGA to provide tailored investment management services to users. Through this model, investors can authorize the system to automatically execute trades and distribute profits based on each investor’s capital proportion. This personalized approach enhances trading efficiency and streamlines the investment process for optimal results.

Maximizing Returns with AGA’s AI Trading Packages and Rebate Structure

AGA’s AI trading packages and rebate structure offer investors a structured approach to maximizing returns based on trading volume and capital allocation. By providing varying trade rebates depending on the investment amount, AGA incentivizes larger capital allocations and enhances overall returns for investors. This strategic rebate system is designed to reward investors for their trading activity and foster long-term profitability.

This image is property of esgthereport.com.

Implementing the Dual Income Model for Enhanced Profits

AGA’s dual income model presents investors with two key income streams: profit sharing and trade rebates. Through profit sharing, investors receive 50% of the profits generated by the AI trading system, with automatic profit distribution upon settlement. Additionally, investors earn trade rebates based on their trading volume, providing an additional income stream for maximizing returns. This dual income model offers a comprehensive approach to wealth generation and financial growth for investors.

Leveraging the Commission Rebate System for Referral Incentives

Agents and clients can maximize their earnings by leveraging AGA’s commission rebate system, which offers referral incentives based on sales volume. By referring clients to the platform, agents earn rebates at varying levels, encouraging network growth and rewarding active community engagement. This structured commission rebate system provides agents with additional income opportunities and reinforces the platform’s commitment to fostering a thriving trading community.

This image is property of www.quantifiedstrategies.com.

Building Active Trading Communities with the Community Rebate System

AGA’s community rebate system incentivizes agents and leaders to build and maintain active trading communities, fostering network growth and engagement. Community leaders earn rebates based on trade volume within their network, with progressively higher rebates at each level. This system encourages sustained community development and incentivizes leaders to expand their networks for mutual benefit.

Ensuring Investor Protection and Welfare Planning

AGA’s investor protection plan includes a reserve fund to cover risks and ensure welfare planning for investors. A portion of each commission contributes to the reserve, providing a safety net for unforeseen market events and safeguarding investors’ interests. This commitment to investor protection enhances trust and confidence in AGA’s platform, offering peace of mind for investors in today’s dynamic financial landscape.

This image is property of opsmatters.com.

Emphasizing Transparency and Real-Time Monitoring for User Confidence

AGA places a premium on transparency and real-time monitoring to provide users with 24/7 access to their accounts and trading activities. This approach ensures transparency, accountability, and user confidence, allowing investors to track their funds and trading performance with ease. By prioritizing user experience and security, AGA demonstrates its commitment to delivering a seamless trading experience for investors worldwide.

Conclusion

Investing in AGA’s AI trading platform offers a unique opportunity to capitalize on advanced trading techniques, AI-driven algorithms, and innovative strategies for maximizing returns in financial markets. By understanding the top strategies and features of AGA’s platform, investors can navigate the complexities of AI-driven trading with confidence and precision. With a focus on risk management, profitability, and investor protection, AGA stands out as a leader in AI quantitative trading, offering a secure and efficient platform for investors seeking low-risk, high-return opportunities in today’s competitive landscape.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com