Impact of Weak US Data on Gold, Silver, Bonds, Stocks, and Oil

In recent weeks, weak economic data from the United States has had a significant impact on various financial markets, including the prices of gold, silver, bonds, stocks, and oil. This article will explore how these markets have been affected by the latest data and what it means for investors.

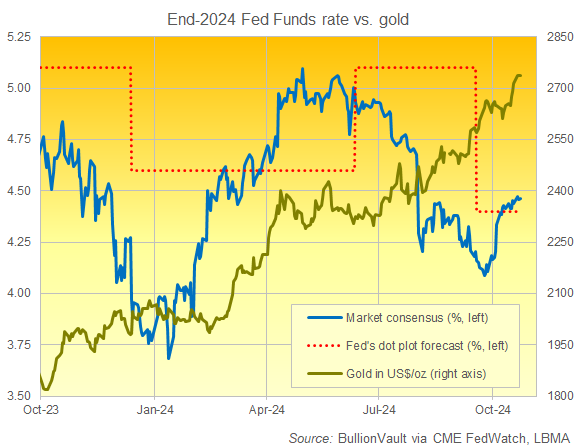

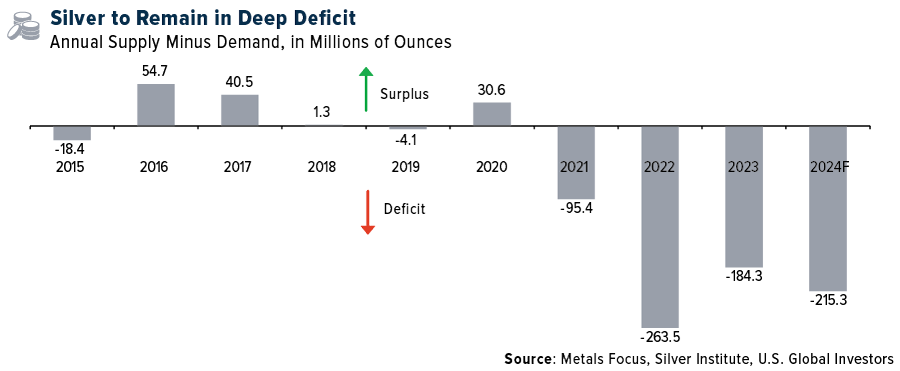

Gold and Silver Prices Fall

The price of gold and silver has fallen in response to the weak economic data coming out of the US. Gold, often seen as a safe-haven asset during times of economic uncertainty, has traditionally seen an increase in value. However, the recent data has caused investors to move away from such assets, leading to a decrease in their prices.

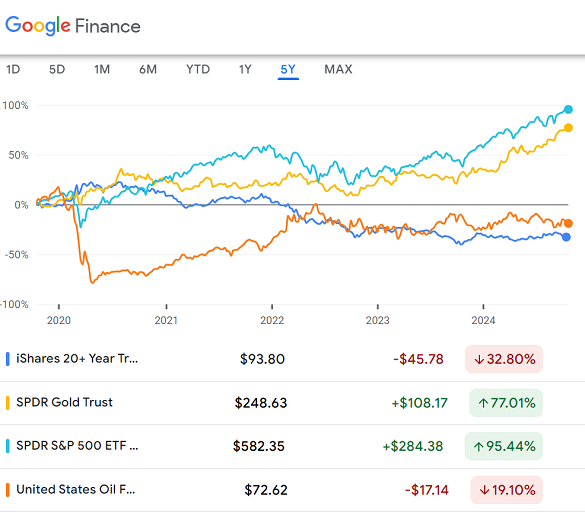

Bonds and Stocks React

Bonds and stocks have also reacted to the weak data, with bond prices falling and stock prices following suit. Bonds, which are considered a safer investment compared to stocks, tend to see an increase in value during times of uncertainty. However, with the recent economic data, investors have shifted their focus towards stocks, leading to a decline in bond prices.

Oil Prices on the Decline

Oil prices have also been hit by the weak US data, with prices falling in response to the economic concerns. The demand for oil is closely tied to the health of the economy, and with predictions of weaker growth, investors have been less optimistic about the future demand for oil, causing prices to drop.

This image is property of www.bullionvault.com.

BullionVault – A Platform for Investing in Precious Metals

BullionVault is a platform that allows investors to buy and sell physical gold, silver, platinum, and palladium. With BullionVault, investors can trade precious metals in a secure and cost-effective manner, without the need to physically store the metals themselves.

Benefits of Investing in Precious Metals

Investing in precious metals such as gold and silver can provide a hedge against economic uncertainty and inflation. Unlike traditional assets like stocks and bonds, the value of precious metals tends to be more stable during times of market volatility, making them a valuable addition to any investment portfolio.

How BullionVault Works

BullionVault operates by allowing investors to buy a share in a physical bar of gold, silver, platinum, or palladium. These metals are stored in secure vaults in various locations around the world, giving investors the peace of mind that their investments are safe and easily accessible when needed.

Diversifying Your Portfolio with Precious Metals

Diversifying your investment portfolio with precious metals can help protect your wealth against market fluctuations and economic uncertainty. By adding gold, silver, platinum, or palladium to your portfolio, you can balance out the risk and potential returns of your overall investments.

Allocating Your Assets

When diversifying your portfolio with precious metals, it’s important to consider how much of your assets should be allocated to these metals. The recommended allocation varies depending on your risk tolerance, investment goals, and overall financial situation.

Benefits of Portfolio Diversification

Portfolio diversification is a strategy that aims to spread your investments across various asset classes to reduce risk. By diversifying your portfolio with precious metals, you can reduce the impact of market downturns on your overall investment performance.

This image is property of i.ytimg.com.

The Role of Precious Metals in a Balanced Portfolio

Including precious metals in a balanced investment portfolio can help achieve long-term financial goals and protect your wealth against economic uncertainty. By diversifying your portfolio with assets like gold and silver, you can enhance its overall stability and reduce risks associated with market volatility.

Hedging Against Inflation

One of the key benefits of including precious metals in a balanced portfolio is their ability to hedge against inflation. Unlike paper currency, which can lose its value over time due to inflation, the value of precious metals tends to increase in response to rising prices.

Safe-Haven Asset

Precious metals are often seen as safe-haven assets during times of economic turbulence, given their intrinsic value and scarcity. By including assets like gold and silver in your portfolio, you can protect your wealth against uncertainties in the financial markets.

This image is property of www.bullionvault.com.

Investing in Precious Metals vs. Traditional Assets

When comparing investing in precious metals to traditional assets like stocks and bonds, there are several key differences to consider. Each type of investment offers its own set of benefits and risks, depending on your investment goals and risk tolerance.

Value Stability

Precious metals tend to have a higher level of value stability compared to stocks and bonds, making them an attractive option for investors looking to diversify their portfolios. The value of gold and silver, for example, is less susceptible to market fluctuations and economic trends.

Inflation Protection

Investing in precious metals can provide protection against inflation, as the value of these assets tends to increase as the purchasing power of paper currency decreases. This makes them an attractive option for investors looking to hedge against the eroding effects of inflation on their wealth.

This image is property of www.bullionvault.com.

Conclusion

In conclusion, the recent weak US data has had a significant impact on various financial markets, including gold, silver, bonds, stocks, and oil. Investors are advised to carefully consider how these changes may affect their investment portfolios and consider diversifying their holdings with precious metals. Platforms like BullionVault offer a secure and convenient way to invest in gold, silver, platinum, and palladium, providing investors with a valuable opportunity to protect and grow their wealth in times of economic uncertainty.