When Will Gold Prices Go Down? Top 3 Factors to Watch

This image is property of av.sc.com.

Introduction

In the world of investing, predicting the movement of gold prices is a complex and nuanced task. With various factors influencing the price of gold, it can be challenging to anticipate whether prices will rise or fall. However, by closely monitoring key indicators and trends, investors can gain valuable insights into potential price movements. In this article, we will explore the top three factors to watch when trying to determine when gold prices will go down.

Understanding Gold Price Fluctuations

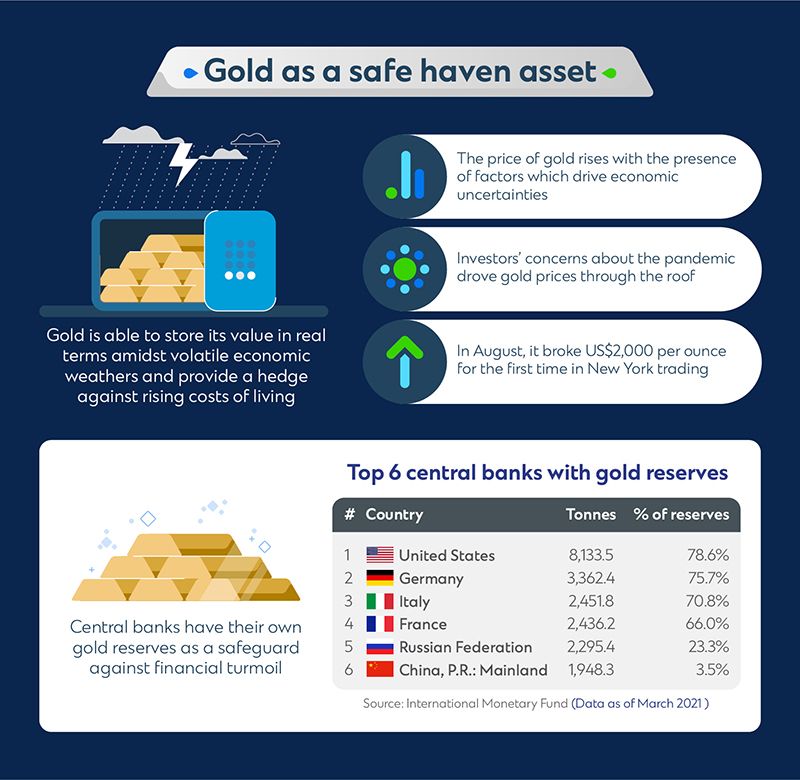

Gold prices are influenced by a myriad of factors, including geopolitical events, economic data, market sentiment, and currency fluctuations. As a result, gold is often regarded as a safe-haven asset that investors flock to during times of uncertainty. However, like any other commodity, the price of gold is subject to fluctuations based on supply and demand dynamics. By analyzing these factors, investors can better predict when gold prices are likely to decline.

Factor 1: Interest Rates

One of the most significant drivers of gold prices is interest rates. Central banks, such as the Federal Reserve in the United States, play a crucial role in setting interest rates, which can impact the value of the US dollar and, consequently, the price of gold. When interest rates are low, gold becomes an attractive investment option since it does not yield any interest or dividends. Conversely, when interest rates rise, the opportunity cost of holding gold increases, leading to a potential decline in gold prices.

Impact of Interest Rate Hikes on Gold Prices

Historically, interest rate hikes by central banks have led to a decrease in gold prices. As investors seek higher returns from interest-bearing assets during periods of rising rates, the demand for gold tends to wane. Additionally, higher interest rates can strengthen the US dollar, making gold more expensive for international buyers. Therefore, monitoring central bank policies and interest rate decisions is crucial in determining the direction of gold prices.

:max_bytes(150000):strip_icc()/What-moves-gold-prices_round2-1f495b66525544fa90f5bc7ec01b3753.png)

This image is property of www.investopedia.com.

Factor 2: Dollar Strength

The strength of the US dollar is another critical factor that influences the price of gold. Since gold is priced in US dollars, a stronger dollar makes gold more expensive for foreign buyers, potentially reducing demand and putting downward pressure on prices. Conversely, a weaker dollar can boost the attractiveness of gold as an investment, leading to price increases.

Relationship Between Gold Prices and the US Dollar

Historically, there has been an inverse relationship between gold prices and the US dollar. When the dollar weakens, gold prices tend to rise, as it becomes more affordable for international buyers. Conversely, a stronger dollar tends to push gold prices lower. Therefore, monitoring the value of the US dollar relative to other currencies is essential in gauging the direction of gold prices.

This image is property of av.sc.com.

Factor 3: Inflation Expectations

Inflation expectations play a vital role in shaping the demand for gold as an inflation hedge. Gold has long been considered a store of value and a hedge against inflation, making it an attractive investment during periods of rising inflation. As investors anticipate higher inflation, they may turn to gold as a way to preserve their purchasing power, driving up demand and, consequently, prices.

Gold as an Inflation Hedge

During times of high inflation, the real value of fiat currencies diminishes, making gold an appealing alternative investment. Since gold has historically retained its value over time, it is often sought after as a safe haven during inflationary periods. By monitoring inflation expectations and economic data, investors can assess whether gold prices are likely to decrease due to lower inflationary pressures.

:max_bytes(150000):strip_icc()/Goldchart-997cf958e5b941a79e319b82a078283f.jpg)

This image is property of www.investopedia.com.

Conclusion

While predicting the exact timing of when gold prices will go down is a challenging task, understanding the key factors that influence gold prices can provide valuable insights for investors. By closely monitoring interest rates, the strength of the US dollar, and inflation expectations, investors can better anticipate potential price movements and make informed decisions about their gold investments. Remember to conduct thorough research, stay informed about market trends, and utilize reliable analysis tools to enhance your understanding of the factors that shape gold prices.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com