Introduction

In today’s fast-paced and ever-changing financial markets, traditional trading methods may not always be able to keep up with the rapid shifts and volatility. This is where AI-powered trading systems like the one offered by Angel Guardian Alliance (AGA) come into play, providing investors with a cutting-edge tool to navigate uncertain market conditions. In this article, we will delve deeper into why AGA’s AI trading system is particularly well-suited for volatile markets and how it can help investors optimize their trading strategies.

Understanding the Challenges of Volatile Markets

Before we discuss why AGA’s AI trading system is ideal for volatile markets, it’s essential to understand the unique challenges that investors face in such conditions. Volatility refers to the degree of variation in trading price series over time, and it can be influenced by various factors such as economic data releases, geopolitical events, and market sentiment. In volatile markets, prices can fluctuate significantly within short periods, making it challenging for traders to predict and react to these changes effectively.

Why Choose AGA’s AI Trading System

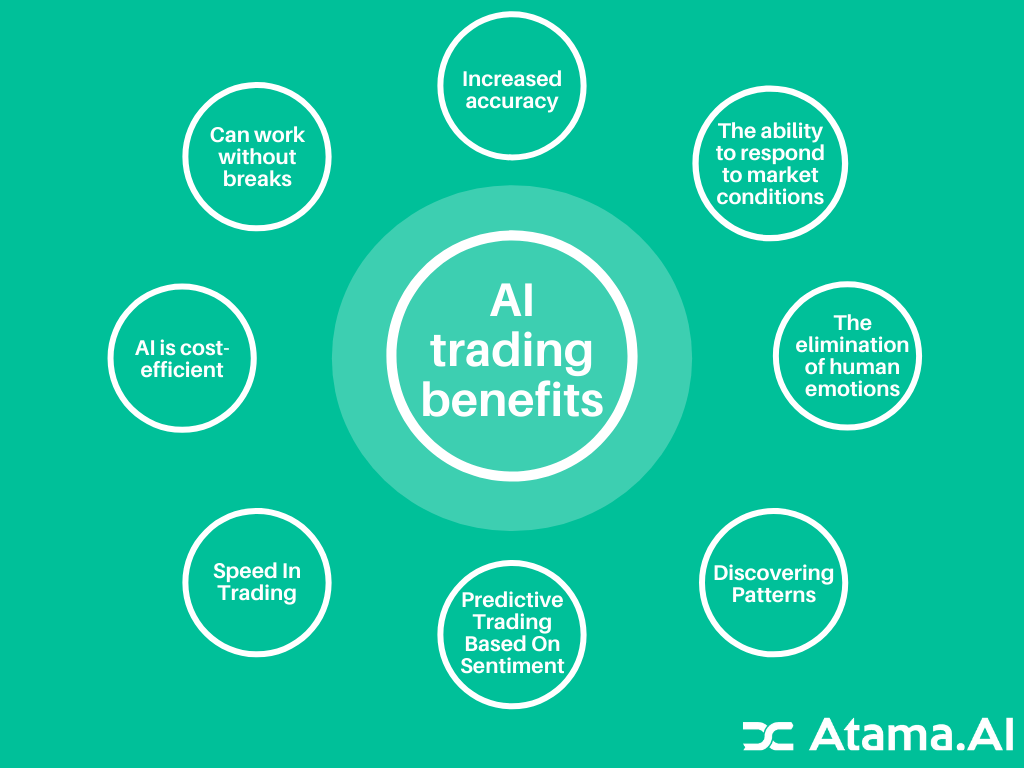

AGA’s AI trading system stands out as an innovative solution that addresses the complexities of volatile markets by leveraging advanced technology and sophisticated algorithms. Unlike traditional trading methods that rely on human decision-making, AGA’s AI system utilizes a quantum algorithm to automate the analysis of market data and execute trades with speed and precision. This approach offers several key advantages for investors operating in volatile market conditions.

1. Zero Liquidation Risk

One of the most significant benefits of AGA’s AI trading system is its ability to minimize liquidation risk, even in highly volatile markets. The system’s ultra-high-frequency trading techniques, with holding times under 30 seconds, ensure that trades are executed swiftly and efficiently, reducing the likelihood of unexpected liquidations due to sudden price fluctuations. This feature provides investors with a higher level of stability and security when operating in turbulent market environments.

2. Multi-Liquidity Access

Another advantage of AGA’s AI trading system is its access to multiple liquidity providers, which enhances trading efficiency and minimizes the impact of market fluctuations. By connecting to various liquidity sources, the system can offer competitive pricing, fast execution, and deep market access, allowing investors to capitalize on trading opportunities in different market conditions. This flexibility is particularly valuable in volatile markets where liquidity and pricing can vary significantly.

3. Risk-Free Arbitrage Opportunities

AGA’s AI trading system is also designed to identify arbitrage opportunities across different markets, enabling investors to generate consistent profits from price discrepancies without exposing themselves to traditional trading risks. By leveraging real-time data analysis and algorithmic trading strategies, the system can exploit temporary mispricings and inefficiencies in the market, leading to profitable arbitrage trades. This risk-free approach is especially beneficial for investors seeking stable returns in volatile market environments.

This image is property of market.us.

The Power of AGA’s AI Trading Packages

AGA offers a range of AI trading packages that cater to investors with different levels of experience and risk tolerance. These packages are designed to provide investors with a comprehensive suite of features and benefits, including profit sharing, trade rebates, and commission structures that enhance overall returns. Let’s explore some of the key features of AGA’s AI trading packages and how they can help investors navigate volatile markets effectively.

Percentage Allocation Management Module (PAMM) Model

AGA’s PAMM model allows investors to benefit from tailored investment management services, where the system automatically executes trades and distributes profits based on each investor’s capital proportion. This hands-free approach to trading ensures that investors can capitalize on market opportunities without the need for constant monitoring or manual intervention. In volatile markets, where quick decision-making is crucial, the PAMM model provides a structured and efficient way to manage investments.

Commission Rebate System

Agents and referral partners can earn rebates by bringing in new clients to AGA’s AI trading platform. The commission rebate system rewards agents based on the trading volume of their referrals, with higher rebates offered for larger sales figures. This incentive structure encourages network growth and enables agents to benefit from the success of their referred clients. In volatile markets, where trading volume and activity levels can fluctuate rapidly, the commission rebate system provides an additional revenue stream for agents.

This image is property of substackcdn.com.

Enhancing Gold Trading with GoldFun

In addition to its AI trading system, AGA has partnered with GoldFun to offer secure and transparent gold trading services to investors. GoldFun is a reputable member of the Hong Kong Gold & Silver Exchange Society and provides advanced trading tools, real-time market data, and secure storage solutions for precious metals investments. By combining AGA’s AI trading expertise with GoldFun’s gold trading platform, investors can access a diverse range of investment opportunities and protect their wealth in times of market volatility.

1. GoldFun’s Secure Storage Solutions

GoldFun offers insured storage options for physical gold holdings, ensuring that investors’ assets are protected against theft or loss. In volatile markets where asset security is a top concern, GoldFun’s secure storage solutions provide investors with peace of mind knowing that their precious metals investments are safely stored and accessible when needed. This added layer of protection enhances the overall risk management framework for investors operating in uncertain market conditions.

2. Investor Protection Plan

To further safeguard investors against unforeseen risks, AGA and GoldFun have implemented an Investor Protection Plan that contributes a portion of each transaction to a reserve fund. This fund is designed to cover unexpected losses and support welfare planning for investors in times of market turmoil. By pooling resources and creating a collective safety net, AGA and GoldFun demonstrate their commitment to protecting investors’ interests and fostering a more secure trading environment for all participants.

This image is property of miro.medium.com.

Conclusion

In conclusion, AGA’s AI trading system offers a robust and reliable solution for investors seeking to navigate volatile markets with confidence and efficiency. By leveraging cutting-edge technology, risk management strategies, and strategic partnerships, AGA provides investors with the tools they need to optimize their trading strategies and maximize their returns in challenging market conditions. Whether you are an individual investor, institutional client, financial professional, or trading enthusiast, AGA’s AI trading system and GoldFun’s gold trading platform offer a comprehensive suite of features that cater to a diverse range of investment needs. Embrace the power of AI-driven trading and secure your financial future in volatile markets with AGA and GoldFun.

If you have any questions, please don’t hesitate to contact us at info@fastcashdc.com